[Buy Now, Pay Later (BNPL) Services See Record-Breaking Spending on Cyber Monday, But Experts Warn of Financial Risks

Buy Now, Pay Later services had their best day yet on Cyber Monday, with consumers spending a record-breaking $991.2 million. This comes as holiday shopping is in full swing, with more consumers making purchases using these services.

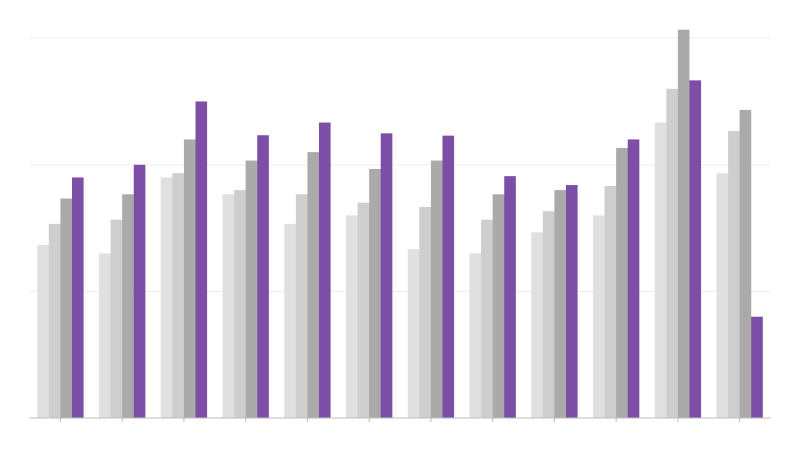

The use of BNPL services has seen a significant increase in the United States, with consumers spending a total of $75.1 billion in 2023, a 14% increase from 2022. Retailers have adopted these options to convert window shoppers into purchasers and encourage customers to add more items to their carts.

However, experts caution that while BNPL services offer flexibility, they also carry financial risks, particularly for young and financially constrained consumers who rely heavily on these services. A study found that users of BNPL services are more likely to face financial hardships, including being unable to pay bills and concerned about making ends meet in the next year.

The use of BNPL services is more common among younger generations, with more than half of Gen Z and Millennials reporting having used the service, compared with just a quarter of Baby Boomers. This is attributed to the appeal of BNPL as a safer alternative to credit cards for those who may struggle to get approved for a credit card.

Despite the convenience offered by BNPL services, experts warn of the risks involved. They note that consumers may become overextended and struggle to make payments, damaging their credit.

The Consumer Financial Protection Bureau has recently issued a rule to regulate BNPL services, providing consumers with additional rights and legal protections, including the right to dispute charges and demand a refund after making a return.

It is essential for consumers to use BNPL services with caution, as some services may include interest or late fees that consumers may not be aware of. The most common issue reported by Gen Z and Millennial users is overspending, and experts recommend using these services for financial planning, but with careful consideration.

Source link